PROFESSIONAL MONEY MANAGEMENT

We’ve all heard the term, “Jack of all trades, master of none”. This is especially true when it comes to investing. Many investors try to master the art of buying and selling equities on top of working 40 to 50 hours per week in their trade. The reality, however, is that investing for retirement should not be treated as an afterthought or a hobby. Relying on a professional money management firm should produce far superior results. Here are three common mistakes that may be avoided by using a money manager:

1. EMOTIONAL MISTAKES

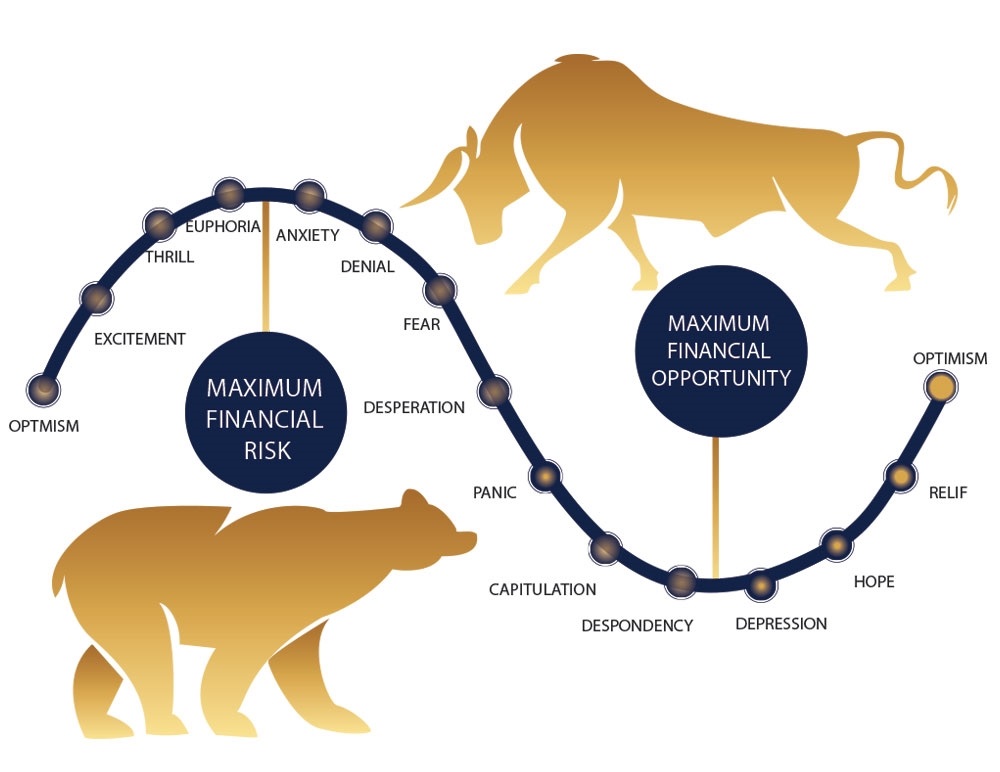

There is a relatively new field of psychology called “behavioral finance”. Behavioral finance involves the study of how and why people make irrational financial decisions. The majority of the time, these decisions are based on emotions such as:

- Fear

- Greed

- Egos

Emotional mistakes can be eliminated by working with professional money managers who actively monitor your portfolios. They make decisions based on facts, not emotions, with your desired goal in mind.

2. TIMING MISTAKES

Most investors don’t have the time required on a daily basis to monitor market trends, statistics, global events and more. Research is the key to making educated investment decisions. Timing mistakes occur when research of certain equities, or of the market as a whole, is random due to an investor’s inability to constantly monitor every situation. Again, using a professional money manager in this capacity should produce much better results.

“The investor’s chief problem, and even his worst enemy is likely to be himself.”

-Benjamin Graham

3. LACK OF EXPERIENCE MISTAKES

Just as you wouldn’t call your CPA to fix a plumbing issue in the house, investing properly requires experience and expertise in the field of finance. Unfortunately, there are several large firms that encourage investors to have a DIY attitude towards saving for retirement. There are numerous websites that allow you to establish your own trading accounts, and even tempt you to trade on margin. For a small percentage of the population, this might work. But for the majority, this is a horrible idea. Experience in investing is key to making good decisions. Don’t be fooled by what you see on TV. DIY investing may also result in huge losses during market downturns.

Wealth Watch Advisors, has invested heavily in technology that utilizes AIIS (Artificial Intelligence Investment Strategy). It provides quantitative modeling and real-time global data assimilation to help our clients capture bull market opportunities, while minimizing negative consequences of severe market corrections and bear markets.